When it comes to classic investment wisdom, few books hold a candle to The Intelligent Investor by Benjamin Graham. This is the book Warren Buffett himself credits as a guiding light for his investment philosophy, and if it’s good enough for the Oracle of Omaha, it’s definitely worth a read.

But let’s be honest – The Intelligent Investor isn’t exactly light reading. The principles are timeless, yes, but the prose can sometimes feel like a financial textbook.

So if you’re looking to grab the highlights without the heavy lifting, here’s a countdown of the top 10 quotes from The Intelligent Investor.

Get ready to glean some timeless insights on money, patience, and keeping calm when the market goes haywire – all with a touch of humour to make it go down easy.

-

“The individual investor should act consistently as an investor and not as a speculator.”

Think of it this way: investing is like committing to a long-term relationship, while speculating is more like swiping right. Graham’s advice here is timeless – don’t get swayed by the excitement of short-term trends; instead, focus on the bigger picture. Remember, The Intelligent Investor isn’t just about making money fast; it’s about building wealth the smart way.

-

“Price is what you pay; value is what you get.”

This gem of wisdom reminds us that just because something is cheap doesn’t mean it’s a good deal. Whether you’re eyeing a stock, a new gadget, or a $7 coffee, remember this lesson from The Intelligent Investor: it’s value that counts, not price. And if you’re thinking, “Wait, didn’t Warren Buffett say that?” – you’re right. He got it from Graham!

-

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

In The Intelligent Investor, Graham uses this metaphor to explain market behaviour. In the short term, stocks may be pushed around by popular opinion and hype, but over time, their true value will be revealed. This quote is a reminder to be patient and let time reveal which investments are really worthwhile.

-

“The essence of investment management is the management of risks, not the management of returns.”

It’s tempting to obsess over gains, but The Intelligent Investor urges readers to focus on managing risks. This quote reminds us that true success in investing comes not from chasing profits but from carefully managing the potential downsides. You can think of this as “defensive driving” in the stock market – avoiding the potholes is half the journey.

-

“To achieve satisfactory investment results is easier than most people realise; to achieve superior results is harder than it looks.”

This is Graham’s way of saying, “Don’t get greedy.” It’s totally possible to achieve good returns with a straightforward, steady approach. However, if you’re trying to beat the market consistently, you’re in for a tough ride. The Intelligent Investor keeps us grounded by reminding us that solid, sensible returns are nothing to sneeze at.

-

“Even the intelligent investor is likely to need considerable willpower to keep from following the crowd.”

You’ve heard of FOMO – The Intelligent Investor may have invented it. Graham knew that the hardest part of investing is staying disciplined when everyone else is buying or selling in a frenzy. This quote reminds us to keep cool, even if it feels like everyone else is on the same bandwagon.

-

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return.”

In other words, don’t invest in something just because it looks good on the surface. The Intelligent Investor teaches that true investing is based on research, analysis, and safety. Speculation, by contrast, is based on a gut feeling, or as Graham might say, “rolling the dice.”

-

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

According to The Intelligent Investor, our emotions are our biggest obstacles to success. Fear, greed, and impatience can all lead to poor decisions. Graham’s quote here is a reminder to be aware of our tendencies and to keep our emotions in check, especially when the market is in turmoil.

-

“While enthusiasm may be necessary for great accomplishments elsewhere, on Wall Street it almost invariably leads to disaster.”

In investing, as in life, there’s a time for passion and a time for restraint. The Intelligent Investor teaches that when it comes to the stock market, it’s best to keep your emotions in check. Too much enthusiasm can lead to risky bets and poor decisions. Instead, Graham advises a steady, measured approach to building wealth.

-

“Successful investing is about managing risk, not avoiding it.”

This final quote captures the essence of The Intelligent Investor. Investing is inherently risky, and trying to eliminate all risk is unrealistic. Instead, successful investors focus on managing risks thoughtfully and balancing potential losses against potential gains. It’s not about avoiding failure; it’s about setting yourself up for long-term success.

Why These Quotes Matter

The Intelligent Investor isn’t just a book about stocks and bonds; it’s a manual on how to think about money and life. Each quote offers wisdom that goes beyond investing, teaching us to focus on value over price, patience over passion, and risk management over risk avoidance. Benjamin Graham’s words remind us that the best approach to investing isn’t flashy or exciting – it’s measured, patient, and deeply logical.

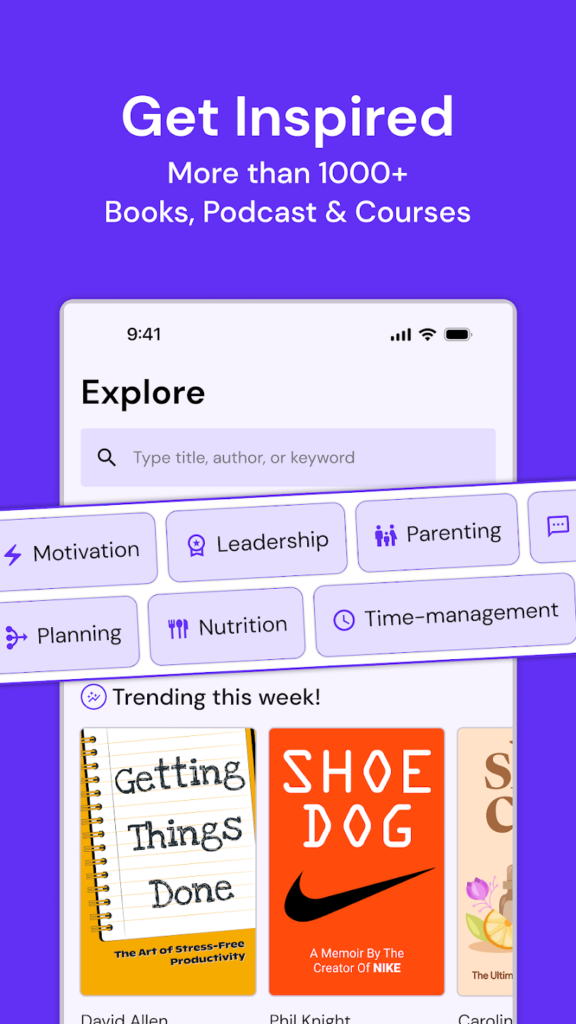

Learn More with Wizdom

If you’re ready to dive into The Intelligent Investor but want the highlights in a time-friendly format, the Wizdom app has got you covered. Wizdom offers condensed summaries of personal development and financial classics like The Intelligent Investor, so you can absorb key insights without having to wade through 600 pages. Whether you’re new to investing or just looking to reinforce the fundamentals, Wizdom is here to help you gain practical knowledge and make smarter decisions.

So why not give Wizdom a try? It’s like having a pocket-sized mentor who’s read all the heavy books for you, ready to share a little wisdom whenever you need it.

Zia Hawwa

Currently pursuing a Degree in Criminology, Zia’s passions lie in the world of literature and the human psyche. She loves what the world has to offer, and is always on the journey of satisfying her curiosity.

Recent Posts

- 25 Top Quotes from The 10X Rule to Supercharge Your Ambition

- 10 Books You Must Read to Succeed in Your Career

- 30 Little Tricks for Big Success in Relationships

- 25 Life-Changing Self-Help Books to Read This December: Boost Your Mood and Your Mind

- 25 Amazing Self-Care Tips for December: Wrap Yourself in Joy, Not Stress