The world of trading is complex and multifaceted, requiring a deep understanding of financial markets, economic principles, and strategic thinking.

Over the years, numerous books have been written by experienced traders, economists, and financial experts, offering insights, strategies, and psychological tips to navigate the trading landscape successfully.

These books cover a wide range of topics, including technical analysis, fundamental analysis, risk management, trading psychology, and various trading methodologies. Whether you are a beginner looking to understand the basics or an experienced trader aiming to refine your strategies, the right book can provide valuable knowledge and inspiration.

The following list includes 20 of the best trading books of all time, each offering unique perspectives and expert advice.

Contents [show]

- 1 Reminiscences of a Stock Operator by Edwin Lefèvre

- 2 Market Wizards by Jack D. Schwager

- 3 The Intelligent Investor by Benjamin Graham

- 4 A Random Walk Down Wall Street by Burton G. Malkiel

- 5 Technical Analysis of the Financial Markets by John J. Murphy

- 6 One Up On Wall Street by Peter Lynch

- 7 Trading for a Living by Dr. Alexander Elder

- 8 The Little Book That Still Beats the Market by Joel Greenblatt

- 9 Fooled by Randomness by Nassim Nicholas Taleb

- 10 Flash Boys by Michael Lewis

- 11 The New Trading for a Living by Dr. Alexander Elder

- 12 The Disciplined Trader by Mark Douglas

- 13 Trading in the Zone by Mark Douglas

- 14 Common Stocks and Uncommon Profits by Philip Fisher

- 15 Jackass Investing by Michael Dever

- 16 The Big Short by Michael Lewis

- 17 Options, Futures, and Other Derivatives by John C. Hull

- 18 The Alchemy of Finance by George Soros

- 19 Manias, Panics, and Crashes by Charles P. Kindleberger

- 20 When Genius Failed by Roger Lowenstein

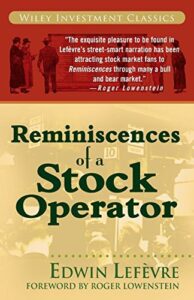

Reminiscences of a Stock Operator by Edwin Lefèvre

This classic book is a fictionalised biography of Jesse Livermore, one of the greatest traders of all time. It offers timeless insights into trading psychology and market behaviour, capturing the essence of the speculative world.

Market Wizards by Jack D. Schwager

Schwager interviews some of the most successful traders and fund managers, uncovering their secrets, strategies, and trading philosophies. The book provides valuable lessons from a diverse group of market legends.

The Intelligent Investor by Benjamin Graham

Known as the father of value investing, Graham’s book provides foundational principles for long term investing. It emphasises the importance of thorough analysis, a disciplined approach, and the concept of intrinsic value.

A Random Walk Down Wall Street by Burton G. Malkiel

Malkiel argues that stock prices are largely unpredictable and that a passive investment strategy is more effective than active trading. The book covers various investment theories and offers practical advice for investors.

Technical Analysis of the Financial Markets by John J. Murphy

This comprehensive guide to technical analysis covers various charting techniques, indicators, and trading systems. Murphy’s book is essential for anyone looking to understand and apply technical analysis in trading.

One Up On Wall Street by Peter Lynch

The author shares his investment philosophy and strategies that led to his success as the manager of the Magellan Fund. The book emphasises the importance of doing your homework and investing in what you know.

Trading for a Living by Dr. Alexander Elder

The author in this book combines technical analysis, trading psychology, and money management in this comprehensive guide. The book provides practical tools and techniques for becoming a successful trader.

The Little Book That Still Beats the Market by Joel Greenblatt

Greenblatt introduces a simple, effective investment strategy called the Magic Formula, which focuses on high quality companies at bargain prices. The book is accessible and insightful for both beginners and experienced investors.

Fooled by Randomness by Nassim Nicholas Taleb

Taleb explores the role of luck and randomness in financial markets and life. The book challenges conventional wisdom and highlights the importance of understanding probability and risk.

Flash Boys by Michael Lewis

Lewis uncovers the world of high frequency trading (HFT) and its impact on financial markets. The book exposes the hidden mechanisms and conflicts of interest in modern trading.

The New Trading for a Living by Dr. Alexander Elder

This updated version of Elder’s classic book includes new insights and techniques for today’s markets. It covers trading psychology, technical analysis, and risk management.

The Disciplined Trader by Mark Douglas

Douglas addresses the psychological challenges traders face and offers strategies for developing the mindset needed for consistent success. The book is a must read for understanding the mental aspects of trading.

Trading in the Zone by Mark Douglas

This followup to The Disciplined Trader delves deeper into trading psychology, focusing on developing the mental discipline and emotional resilience required for successful trading.

Common Stocks and Uncommon Profits by Philip Fisher

Fisher’s investment philosophy focuses on investing in high quality companies with growth potential. The book provides insights into evaluating a company’s management and competitive advantage.

Jackass Investing by Michael Dever

The author in this book challenges traditional investment wisdom and presents innovative strategies for creating a diversified and profitable investment portfolio. The book encourages thinking outside the box and questioning conventional beliefs.

The Big Short by Michael Lewis

Lewis tells the story of the financial crisis of 2008 through the eyes of a few traders who saw it coming and profited from it. The book provides a compelling look at the factors leading up to the crisis and the world of short selling.

Options, Futures, and Other Derivatives by John C. Hull

This comprehensive textbook covers the complex world of derivatives, including options and futures. It provides theoretical and practical insights, making it essential for those interested in derivatives trading.

The Alchemy of Finance by George Soros

Soros shares his theories on reflexivity and how they apply to financial markets. The book provides a deep dive into his trading strategies and the philosophy behind his success.

Manias, Panics, and Crashes by Charles P. Kindleberger

Kindleberger examines the history of financial crises, exploring their causes and consequences. The book offers valuable lessons for understanding market bubbles and avoiding investment pitfalls.

When Genius Failed by Roger Lowenstein

The author tells the story of the rise and fall of LongTerm Capital Management, a hedge fund that collapsed spectacularly. The book provides insights into risk management and the dangers of overconfidence in trading.

These 20 trading books offer a wealth of knowledge and practical advice for traders and investors at all levels. From understanding market psychology and technical analysis to exploring innovative investment strategies and historical case studies, these books cover a broad spectrum of topics essential for successful trading.

The common thread among these books is the emphasis on discipline, thorough analysis, and the constant evolution of one’s trading approach. By exploring these books, traders can gain valuable insights into the complexities of financial markets, develop robust strategies, and cultivate the psychological resilience necessary for long term success.

Despite you being a newbie or a seasoned trader, these books provide the tools and perspectives needed to navigate the ever changing landscape of trading with confidence and skill.

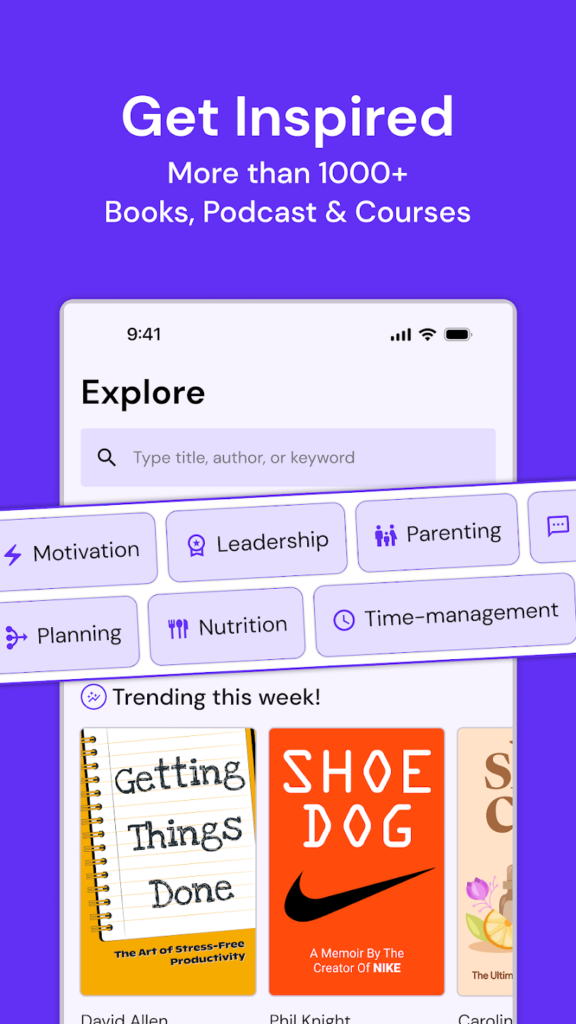

Want to know more about such books?

Read the complete set of most-read books FREE on the Wizdom App

Don’t forget to check the app out and get armed with 1500+ of the world’s best books, courses, podcasts, infographics, and more!

Find the link here to an endless journey of reading!