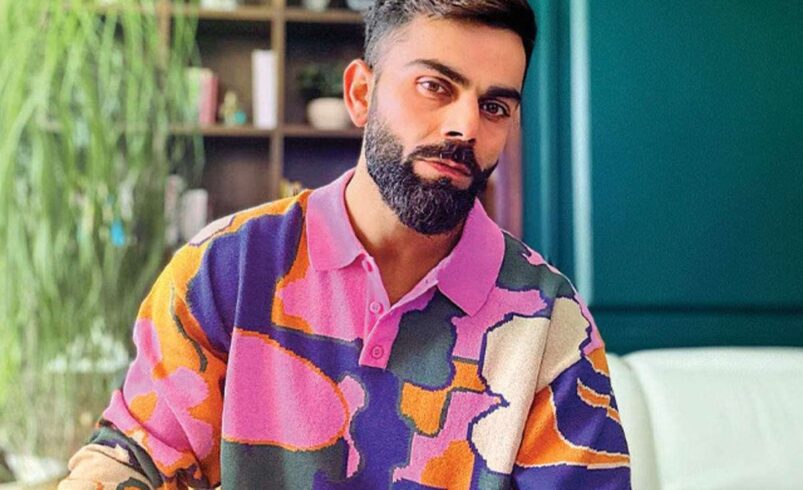

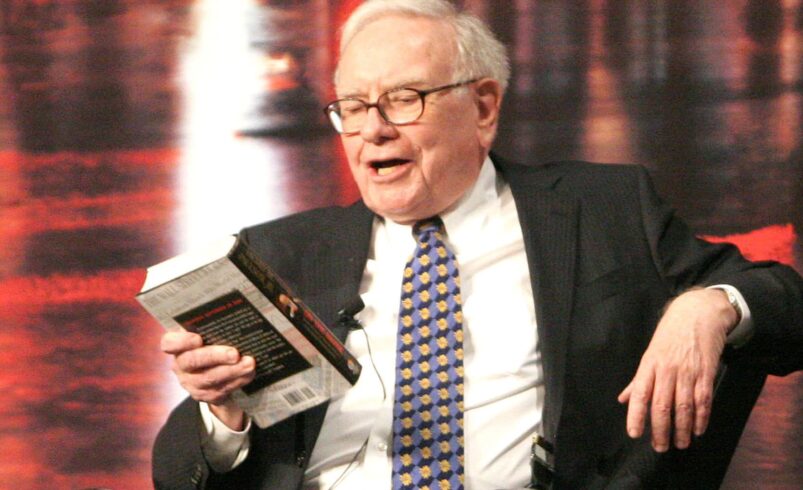

Warren Buffett, often referred to as the “Oracle of Omaha,” is a legendary and one of the most influential investors of our time who has built an unparalleled track record of success over the course of his decades-long career. Born in 1930 in Omaha, Nebraska, Buffett displayed a keen aptitude for investing and finance from a very young age, making his stock market debut with market investments at just 11 years old. In 1965, Buffett took control of a struggling manufacturing company and transformed it into one of the most victorious holding companies in the world. As the chairman and CEO of Berkshire Hathaway, Buffett has piled up a fortune worth billions, and his investment strategies and insights have been studied and revered by countless individuals around the globe.

Buffett’s consistent market-beating returns and significant investing success lend gigantic credibility to his views and insights. He has proven his calibre_ to identify undervalued companies and make profitable and long-term investments. Beyond his investment expertise, Buffett is also referred to as a sage and mentor figure in the financial realm. His prowess in investing principles, combined with his reputation for rational, unemotional decision-making and strong ethical standards. Such attributes are reflected in the books recommended by Warren Buffett. By scrabbling through the books recommended by Buffett endorsers, readers gain direct access to the accumulated wisdom.

Here’s a list of 20 transformative reads beloved by billionaire investor Warren Buffett to unlock your investing genius.

Contents

- 1 How to Win Friends and Influence People by Dale Carnegie

- 2 How to Win Friends and Influence People

- 3 The Smartest Guys in the Room by Bethany McLean and Peter Elkind

- 4 The Intelligent Investor, by Benjamin Graham

- 5 The Intelligent Investor

- 6 Poor Charlie’s Almanack by Peter Kaufman

- 7 Where are the customers’ yachts? by Fred Schwed

- 8 40 Chances by Howard G. Buffett

- 9 The Outsiders, by William Thorndike

- 10 The Outsiders

- 11 Keeping At It: The Quest for Sound Money and Good Government by Paul Volcker

- 12 Bull! A History of the Boom and Bust, 1982–2004 by Maggie Mahar

- 13 Shoe Dog by Phil Knight

- 14 Shoe Dog

- 15 The Great Crash of 1929, by John Kenneth Galbraith

- 16 Jack Straight From The Gut by Jack Welch

- 17 Supermoney by Adam Smith

- 18 The Man Behind the Microchip, by Leslie Berlin

- 19 The Science of Hitting, by Ted Williams

- 20 Dream Big by Cristiane Correa

- 21 Dream Big

- 22 A Short History of Nearly Everything by Bill Bryson

- 23 A Short History of Nearly Everything

- 24 The Ten Commandments for Business Failure by Donald Keough

- 25 Take on the Street by Arthur Levitt

- 26 The Moment of Lift by Melinda Gates

- 27 The Moment of Lift

How to Win Friends and Influence People by Dale Carnegie

This classic self-help book on interpersonal skills is one that Buffett has repeatedly recommended over the years, highlighting its timeless wisdom. The book emphasizes the need for the readers to develop a deeper understanding of human nature than just using manipulation as a tactic to influence people and provides practical advice on communication and avoiding criticism.

How to Win Friends and Influence People

Dale Carnegie communicate 1936

Available in: | |

The Smartest Guys in the Room by Bethany McLean and Peter Elkind

This book is an in-depth examination of the Enron scandal, which Buffett found fascinating as a case study in corporate greed and deception. The book serves as a cautionary tale about the dangers of unchecked corporate greed, lax regulation, and the importance of transparency and accountability in business.

The Intelligent Investor, by Benjamin Graham

Buffett has called this book “the best book on investing ever written.” It lays the foundation for value investing, an approach that focuses on finding undervalued companies with strong fundamentals. It is a seminal work on value investing, teaching readers prudent, long-term strategies to achieve steady investment returns while minimising risk through analytical thinking.

The Intelligent Investor

The Definitive Book on Value InvestingBenjamin Graham Business 1949

Available in: | |

Poor Charlie’s Almanack by Peter Kaufman

This collection of writings and speeches by Buffett’s longtime business partner, Charlie Munger, provides unique insights into Munger’s unconventional and highly successful approach to investing and business. It offers practical advice on decision-making, human psychology, and achieving lifelong success.

Where are the customers’ yachts? by Fred Schwed

This book provides a humorous and insightful look at the investment industry and how it often fails to serve the best interests of its clients. Buffett vouches for this book for its witty, perceptive exploration of the financial industry, exposing the disconnect between Wall Street’s promises and the reality that most investors do not actually get rich.

40 Chances by Howard G. Buffett

Warren Buffett’s son Howard writes about his philanthropic efforts to address global hunger and poverty, an area of great importance to the elder Buffett. This book is a memoir and a manifesto advocating sustainable, innovative solutions to global hunger and poverty, drawing on the author’s experience as a farmer and philanthropist.

The Outsiders, by William Thorndike

Buffett praised this book for its profiles of eight unconventional CEOs and their unorthodox yet effective strategies for capital allocation and business management. Thorndike provides a study of eight unconventional CEOs who achieved remarkable long-term success by bucking mainstream management practices and prioritising shareholder value over short-term growth.

Keeping At It: The Quest for Sound Money and Good Government by Paul Volcker

As a former Federal Reserve chairman, Volcker’s insights on monetary policy and good governance are a matter of interest to Buffett. The book provides insights into his career in public service and his principled approach to economic policymaking to maintain financial stability.

Bull! A History of the Boom and Bust, 1982–2004 by Maggie Mahar

This book provides a detailed, in-depth examination and historical account of the stock market cycles and speculative bubbles that characterised the late 20th century, offering insights into the psychology and forces driving market booms and busts, which fascinated Buffett as an observer of market psychology.

Shoe Dog by Phil Knight

This memoir by the Nike founder provides an inside look at entrepreneurship, brand-building, and navigating challenges, which resonated with Buffett. It recounts the challenges faced, humble origins, and gutsy entrepreneurial spirit that built one of the world’s most iconic and innovative brands.

The Great Crash of 1929, by John Kenneth Galbraith

As an astute observer of market history, Buffett found value in this authoritative account of one of the most significant financial crises in modern history. It sheds light on the stock market crash that precipitated the Great Depression, exploring the economic, social, and political factors that led to this calamity.

Jack Straight From The Gut by Jack Welch

Buffett appreciated Welch’s candid insights and unconventional leadership as the former CEO of General Electric. This book records Jack’s transformative leadership, management philosophies, and the ups and downs of his storied corporate career.

Supermoney by Adam Smith

This book offers a comprehensive overview of the investment industry and financial markets, which aligns with Buffett’s broad knowledge and understanding of the investment landscape. It is an insightful and entertaining exploration of the world of high finance, offering a behind-the-scenes look at the personalities, trends, and dynamics shaping the investment landscape.

The Man Behind the Microchip, by Leslie Berlin

A biography of Robert Noyce, the co-inventor of the integrated circuit, interested Buffett for its insights into technological innovation and entrepreneurship. The book accounts for the for the pioneering work of Robert Noyce, co-founder of Intel and a key figure in the development of the modern semiconductor industry.

The Science of Hitting, by Ted Williams

As a baseball enthusiast, Buffett appreciated this book’s lessons on discipline, preparation, and the pursuit of excellence, which can be applied to investing. Drawing on an instructional guide, the book delves into biomechanics, psychology, and strategies for success.

Dream Big by Cristiane Correa

A biography of Brazilian entrepreneur and philanthropist Jorge Paulo Lemann, co-founder of 3G Capital, laying out an inspiring approach to entrepreneurship, innovation, social impact, and business success, intrigued Buffett.

Dream Big

Know What You Want, Why You Want It, and What You're Going to Do About ItBob Goff Non fiction 2019

Available in: | |

A Short History of Nearly Everything by Bill Bryson

Buffett’s wide-ranging intellectual curiosity drew him to this accessible and engaging overview of the scientific origins of the universe, Earth, and life, blending scientific discoveries with captivating storytelling.

A Short History of Nearly Everything

Bill Bryson Mindfulness 2003

Available in: | |

The Ten Commandments for Business Failure by Donald Keough

This book’s insights on the common pitfalls faced by businesses resonated with Buffett’s focus on avoiding mistakes and maintaining a margin of safety. It outlines 10 common mistakes businesses make, drawing on the author’s extensive experience to provide practical wisdom on how to avoid corporate pitfalls.

Take on the Street by Arthur Levitt

As the former chairman of the SEC, Levitt’s insights on financial regulation and protecting investor interests lay out a valuable virtue for Buffett.

The Moment of Lift by Melinda Gates

Buffett’s long-standing commitment to philanthropy drew him to this book about empowering women and girls around the world to improve health, education, and economic outcomes for individuals, families, and communities.

The Moment of Lift

How Empowering Women Changes the WorldWomen in Leadership 2019

Available in: | |

Collectively, these books recommended by Warren Buffett cover a wide range of topics; reading them can help you gain valuable insight into the mindset and decision-making processes that have contributed to Buffett’s remarkable triumph as an investor and businessman.

Ayushi Lathiya

Ayushi Lathiya is currently pursuing engineering in electronics and communication. In the vortex of her imagination, she's strolling around a beach, listening to Taylor Swift and true-crime podcasts. Ayushi's perfect evening is flipping through books and bringing the characters to life in her head.

Recent Posts

- 25 Top Quotes from The 10X Rule to Supercharge Your Ambition

- 10 Books You Must Read to Succeed in Your Career

- 30 Little Tricks for Big Success in Relationships

- 25 Life-Changing Self-Help Books to Read This December: Boost Your Mood and Your Mind

- 25 Amazing Self-Care Tips for December: Wrap Yourself in Joy, Not Stress